For a few years, trade shows lived in an awkward middle ground.

They were back on the calendar, but not fully back in the strategy. Budgets were approved cautiously. Expectations stayed fuzzy. Success was often explained after the show rather than defined upfront.

That phase is ending.

In 2026, trade shows are no longer being treated as legacy channels or discretionary spends. They are being funded with intent, reviewed with seriousness, and discussed alongside other core growth investments. One clear signal of this shift: 82% of B2B trade show marketers plan to increase their event spending in 2026.

With that renewed confidence comes pressure. Trade shows are no longer fighting for relevance. They are being asked to justify their role.

This piece is our viewpoint on what that means for event teams planning for 2026. The goal is not to prescribe formats or tactics, but to help leaders set realistic expectations around budgets, priorities, and outcomes, and to align on what “success” should actually look like going forward.

Wait, why are trade shows back in the boardroom conversation?

The renewed focus on trade shows is not driven by nostalgia or a return-to-normal mindset. It is driven by predictability.

At a time when digital channels feel crowded and incremental gains are harder to unlock, trade shows offer something distinct. They compress attention, authority, and access into a short, intense window. Brand visibility, relationship-building, and commercial conversations all happen in the same physical space.

That compression matters to leadership teams.

Senior stakeholders increasingly see exhibitions and conferences as one of the few channels where buyer intent is visible, tangible, and time-bound. That reliability is why trade shows are again being discussed at the same level as other strategic growth levers.

Investment is rising, but the way it’s being justified has changed

Yes, investment is going up. But the more important shift is how that investment is being framed internally.

Trade shows are no longer positioned as experimental bets or brand-only plays. They are increasingly viewed as contributors to revenue influence, partner visibility, and market credibility. That reframing changes how decisions are made.

Instead of asking whether trade shows matter, leadership teams are asking:

- Which trade shows earn a place in our portfolio?

- What role does each one play?

- What outcomes are realistic to expect?

As budgets rise, tolerance for ambiguity drops. Event leaders are being asked fewer philosophical questions and more strategic ones.

Rethinking what ‘success’ means for each stakeholder

One of the most meaningful shifts heading into 2026 is how success is defined.

Single-metric definitions are giving way to multi-dimensional ones. Lead counts still matter, but they are no longer expected to carry the full story. Success now looks different depending on who you ask.

- For commercial leaders

- Pipeline influence, not just immediate conversion

- Partner and ecosystem alignment

- Quality of sales-supported meetings

- For marketing leaders

- Brand credibility within a specific industry or segment

- Media coverage and PR visibility

- Share of voice during and around the event

- For event and portfolio directors

- Quality of senior-level conversations

- Fit within the overall event portfolio

- Consistency of outcomes year over year

While this broader definition improves alignment, it also requires greater discipline. When success has multiple dimensions, it needs to be agreed on before the event, not justified after.

Bigger budgets come with sharper scrutiny

Rising investment does not mean relaxed oversight. If anything, it increases scrutiny.

Alongside increased spend, 37% of trade show marketers report higher ROI from their exhibitor programmes.

That optimism raises expectations.

Portfolio directors and commercial leaders want to understand how each trade show fits into the wider mix, what it is responsible for delivering, and what “good” looks like in context.

This has real implications for planning.

Trade shows are no longer assessed in isolation. Decisions around booth size, sponsorships, speaking slots, and supporting activity are being weighed against opportunity costs across the entire portfolio.

The question has shifted from:

“Did the event go well?”

to:

“Was this the right event to invest in at all?”

Engagement and PR are no longer secondary outcomes

Another clear shift heading into 2026 is the growing importance of engagement quality and PR value.

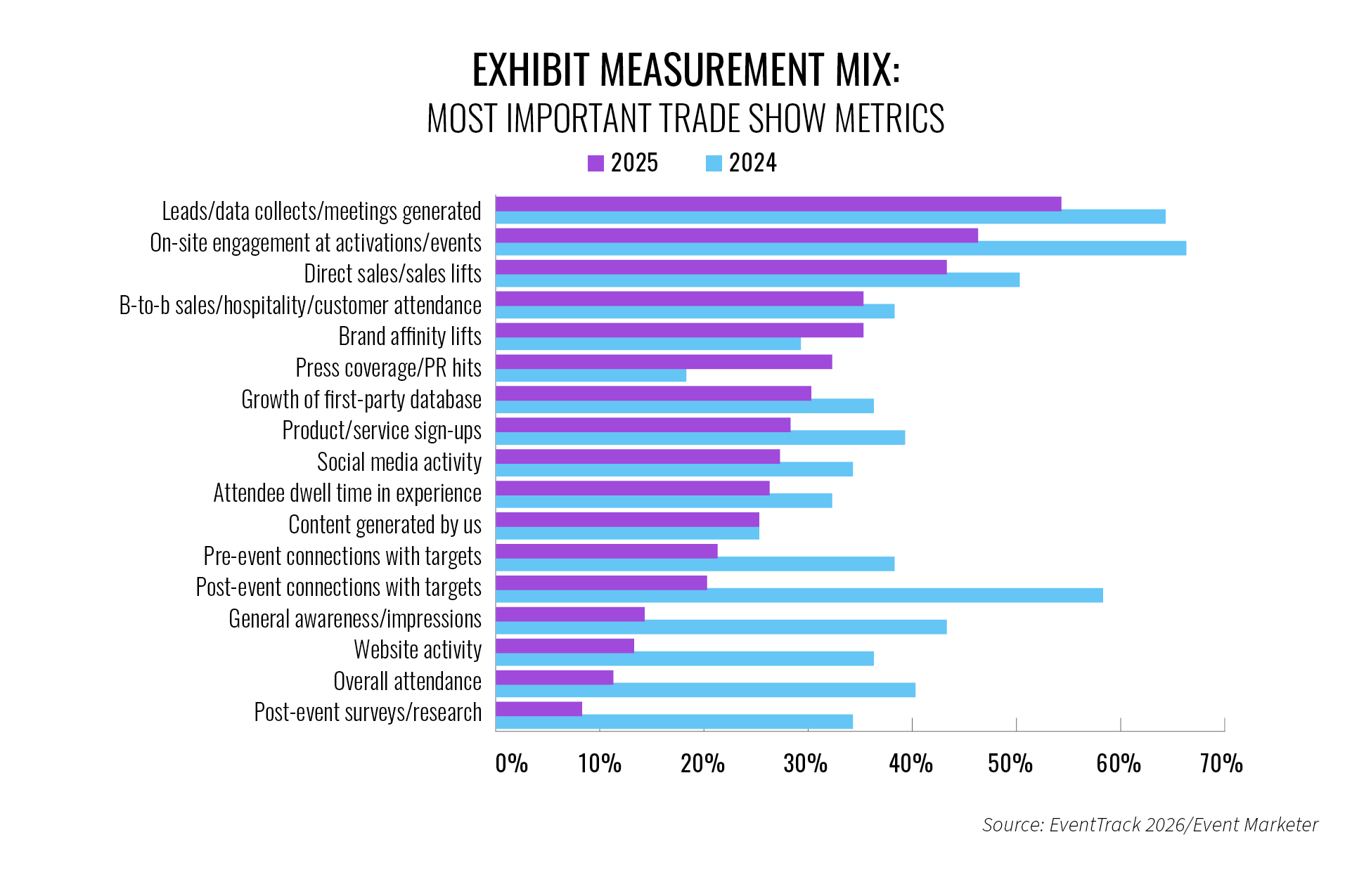

Measurement preferences may look familiar on the surface, but priorities are changing. While leads and data collection remain important, engagement and PR are climbing fast. Nearly one-third of trade show marketers now include media coverage as a core success metric, almost double the number from two years ago.

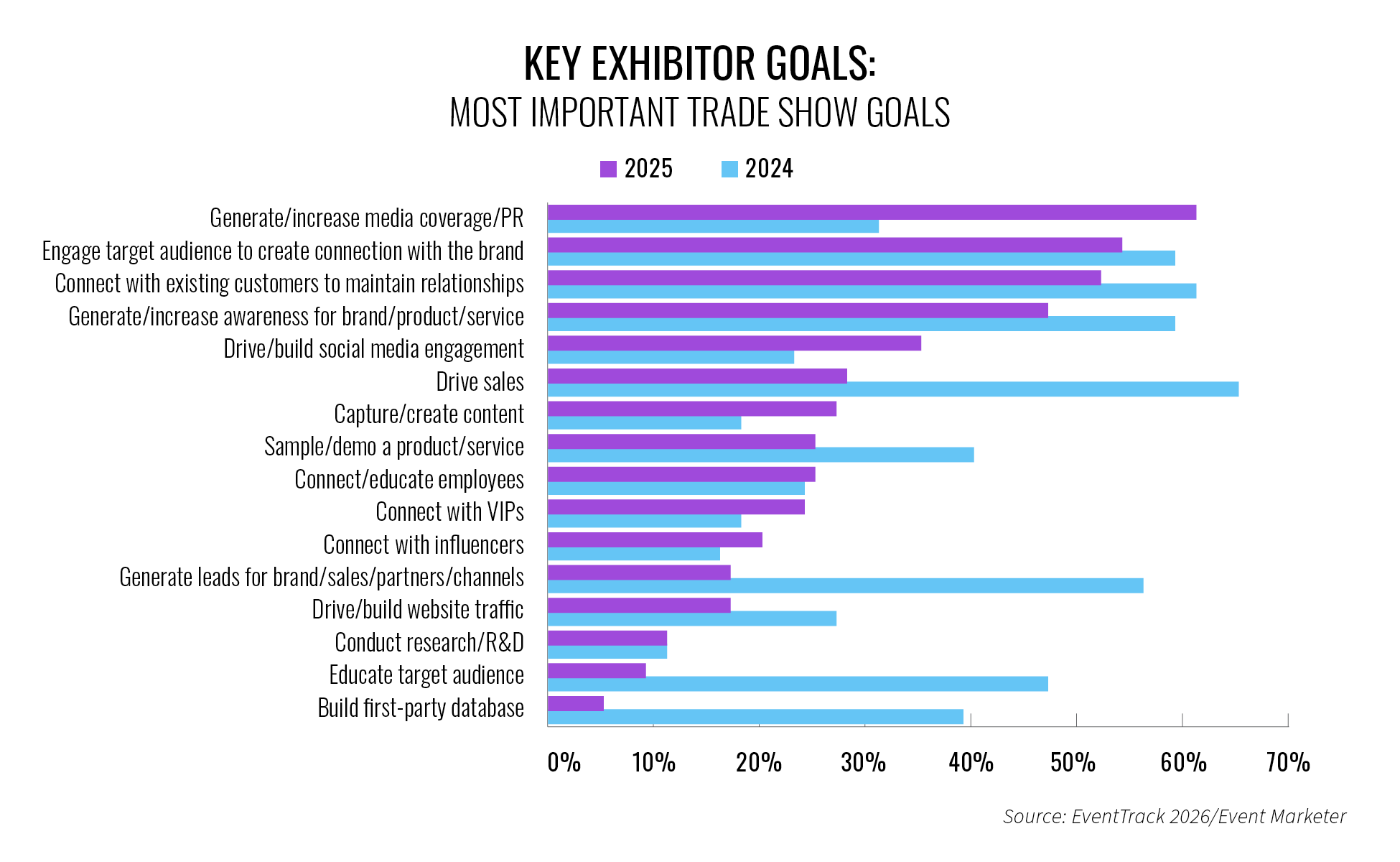

PR, in particular, has moved from a bonus outcome to a primary objective. 61% of trade show marketers say PR is a top goal in 2026.

Engagement is also being defined more precisely. It now includes:

- One-on-one meetings that support sales teams

- Smarter data capture

- More engaging demos and presentations

- Stronger content and signage

- Social amplification during and after the event

Trade shows are being used to reinforce positioning, not just collect contacts. The event itself has become a credibility engine, with impact that extends well beyond the show floor.

This shift places more responsibility on pre-event planning. Engagement and PR outcomes cannot be improvised onsite. They require alignment across marketing, communications, sales, and leadership well in advance.

Also Read: For a deeper look at how session and engagement data can translate into pipeline impact, this related read may be useful: https://www.bridged.media/blog/monetise/sponsor-roi/

Measurement hasn’t changed much (but expectations around it… have)

Interestingly, there is no dramatic overhaul of event measurement frameworks heading into 2026. Most teams are still tracking familiar indicators: leads, meetings, pipeline influence, and brand metrics.

What has changed is how those numbers are expected to be interpreted.

Stakeholders want narratives, not just dashboards. They want to understand the contribution, even when it is indirect or long-term.

The real tension many teams face is not a lack of data, but a lack of shared understanding. Sales, marketing, and leadership often look at the same numbers and draw different conclusions. Aligning with the metrics’ meaning has become just as important as collecting them.

Where AI fits into trade show strategy

Most trade show teams today are short on usable clarity when it actually matters.

In practice, trade show data still acts like a post-event artefact. It is assembled after the show closes, reviewed once budgets are already under discussion, and referenced when portfolio decisions have largely been made. By the time insight surfaces, it is explaining outcomes rather than shaping direction.

At portfolio scale, however, that lag starts becoming a constraint. The people setting priorities need confidence while options are still open.

Here’s what is actually broken

The issue is largely structural.

Meaning to say… trade show performance signals are inherently distributed and set.

- Registration systems capture intent

- CRM records capture sales motion

- Badge scans, meeting logs, sponsor activity, session engagement, and post-event feedback all reflect different aspects of value.

The problem is… none of these is wrong, but none is complete either.

The full picture only emerges after manual stitching, interpretation, and debate. That process takes time, all while planning continues anyway.

The predictable result is obviously that decisions are made on partial insights and information.

Now, as expectations rise in 2026, the risk increases. Scrutiny is increasing faster than most teams can produce coherent, decision-ready insight.

How do most teams currently compensate?

The common response is data consolidation. Meaning, data sources are pulled into a central reporting layer. Dashboards become more sophisticated. Manual reporting effort goes down.

This improves visibility, but it does not resolve the core problem because interpretation still sits outside the system.

Someone still has to:

- Connect engagement signals to commercial relevance

- Explain why two similar events performed differently

- Answer leadership questions that were not anticipated in the original report

Dashboards describe activity. They rarely accelerate judgment. The bottleneck moves from data collection to sense-making, but it does not disappear.

Here’s what changes in a more ‘agentic’ operating model

A more advanced approach treats insight as an input, with performance understanding available while decisions are still fluid. Insight surfaces during planning (not after it). The reporting phase stops being a separate exercise and becomes a continuous layer that informs trade-offs as they occur.

This is where agentic approaches matter, not because they are novel, but because they compress time between question and answer.

When teams can interrogate performance in plain language and receive responses that include both evidence and interpretation, several things change at once. Repeated questions become standardised instead of reinvented. Cross-functional discussions move faster because everyone is reacting to the same source of understanding. Planning conversations becomes more disciplined because assumptions are easier to test in real time.

Over time, this changes how portfolios are managed. Decisions are made earlier, with greater confidence, and justifications become easier because insight arrives before positions harden, not after.

That is the practical role AI plays in trade show strategy for 2026: providing earlier clarity in a planning cycle that has historically relied too heavily on hindsight.

What this looks like in practice: using our Data Explorer Agent

One practical example of how this shift shows up is in how teams access and interrogate event performance data.

A Data Explorer Agent sits on top of live analytics and connects to the systems teams already rely on: registration data, website engagement, content performance, sponsor pages, and post-event behaviour. Instead of asking someone to pull a report or interpret a dashboard, event leads can ask direct questions and get direct answers, backed by the underlying numbers and a short explanation that makes the result usable.

The questions are the same ones that slow teams down today:

- Which sessions or pages drove the strongest engagement this week?

- Where did the drop-off increase after a programme or agenda change?

- How did return visits shift after a keynote, announcement, or campaign push?

- What happened to engagement on sponsor or exhibitor pages after the event?

The difference is the speed and completeness of the response.

For example, instead of a screenshot of a chart or a spreadsheet export, the answer arrives in a simple table, with relevant context and a concise interpretation that can be shared internally. This change in format makes it immediately usable in planning discussions, budget reviews, or cross-team conversations.

Over time, this changes how insight functions inside the organisation. Recurring questions become repeatable rather than improvised. Conversations move faster because evidence is easy to access and align on. Planning becomes easier to defend because insight arrives early enough to influence priorities, rather than late as an explanation of what already happened.

In that sense, a data explorer brings operational value by reducing friction between data and decision-making (exactly when clarity matters most).

AI is becoming part of the conversation around events, but it is often introduced at the wrong level. A more useful way to think about its role is to start with the problem it is meant to address.

Let’s start with… what’s broken, and why?

Event data is fragmented. Insights live across CRM systems, marketing platforms, spreadsheets, and post-event reports. By the time everything is consolidated, planning decisions have already moved on.

Reporting is largely retrospective. It explains what happened, but rarely informs what should change next.

The current status quo

Most teams rely on manual synthesis and static reporting. Analysis happens after the event cycle ends, which limits its strategic value.

As a result, trade show planning for next year often begins with partial recall and incomplete insight.

The agentic future scenario

Looking ahead, AI has the potential to support faster synthesis and earlier visibility. Of course, not by replacing human judgment, but by reducing the lag between activity and understanding.

That could mean earlier signals around engagement quality, faster pattern recognition across events, and more informed portfolio decisions. The real value lies in better planning conversations, not in automating the event itself.

So, what does a ‘good’ trade show look like in 2026?

Pulling these threads together, a successful trade show in 2026 tends to share a few characteristics.

It has a clearly defined role within the wider event portfolio. It is not expected to do everything, but it is expected to do something specific well.

Success criteria are aligned across stakeholders before the event. Marketing, sales, and leadership understand what outcomes matter most.

Engagement and visibility are planned intentionally, not treated as byproducts.

Measurement focuses on contribution rather than perfection. The event is evaluated fairly, in line with its objectives.

The strongest teams are not necessarily doing more. They are doing fewer things, with greater clarity.

Strategic Questions Event Leaders Should Be Asking Now

As teams plan for 2026, the most valuable work often happens before budgets are finalised or venues are booked.

Questions worth sitting with include:

- Which trade shows genuinely earn their place in our portfolio?

- What does success look like for this event, and for whom?

- Where are stakeholder expectations misaligned before we begin?

- What outcomes are realistic, given the role this event plays?

Answering these early is what allows trade shows to function as serious business investments, rather than as line items to defend.

FAQs for Building a Successful B2B Trade Show Strategy for 2026

Q. What is a realistic definition of trade show success in 2026?

In 2026, trade show success is rarely defined by a single metric. Most organisations assess success across multiple dimensions, including pipeline influence, brand credibility, PR visibility, quality of senior-level conversations, and how well the event fits into the broader event portfolio. The key shift is agreeing on these outcomes upfront, rather than retroactively justifying performance.

Q. Why are B2B companies increasing investment in trade shows again?

B2B companies are increasing trade show investment because exhibitions and conferences offer predictable, high-intent engagement in a crowded marketing environment. Trade shows bring together brand exposure, relationship-building, and commercial conversations in a compressed timeframe, making them easier for leadership teams to evaluate compared to fragmented digital channels.

Q. How should event teams think about trade shows as part of a portfolio?

Instead of planning events in isolation, teams are increasingly assessing trade shows as part of an overall event portfolio. Each event is expected to play a specific role, whether that is driving senior conversations, supporting sales teams, strengthening partnerships, or reinforcing brand positioning. Portfolio thinking helps prioritise where budgets, time, and effort are best spent.

Q. Are leads still the most important trade show metric?

Leads still matter, but they no longer tell the full story. Many organisations now balance lead volume with engagement quality, meeting seniority, PR impact, and downstream pipeline influence. This broader measurement approach reflects how trade shows contribute to growth in ways that are not always immediate or directly attributable.

Q. Why is PR becoming a core trade show objective?

PR has moved from a secondary benefit to a primary objective for many trade show marketers. Media coverage, thought leadership visibility, and social amplification extend an event’s impact beyond the show floor. As a result, PR outcomes now require deliberate planning and coordination well before the event begins.

Q. Has trade show measurement changed significantly in recent years?

The tools and frameworks used to measure trade shows have remained relatively stable. What has changed is the expectation around interpretation. Stakeholders increasingly want clear narratives that explain how an event contributed to business goals, even when the impact is indirect or long-term.

Q. How does AI fit into trade show strategy without replacing human judgment?

AI’s potential role in trade show strategy is to improve insights and planning, not to automate events. By reducing the time it takes to synthesise data and identify patterns across events, AI can support better decision-making and earlier alignment. Human judgment remains essential for setting priorities and defining success.

Q. When should teams start planning for trade shows in 2026?

The most valuable planning work happens before budgets are finalised or venues are booked. Early alignment on objectives, stakeholder expectations, and the role each event plays within the portfolio allows trade shows to function as intentional investments rather than defended line items.